[ad_1]

Tuesday, April 18th, 2023

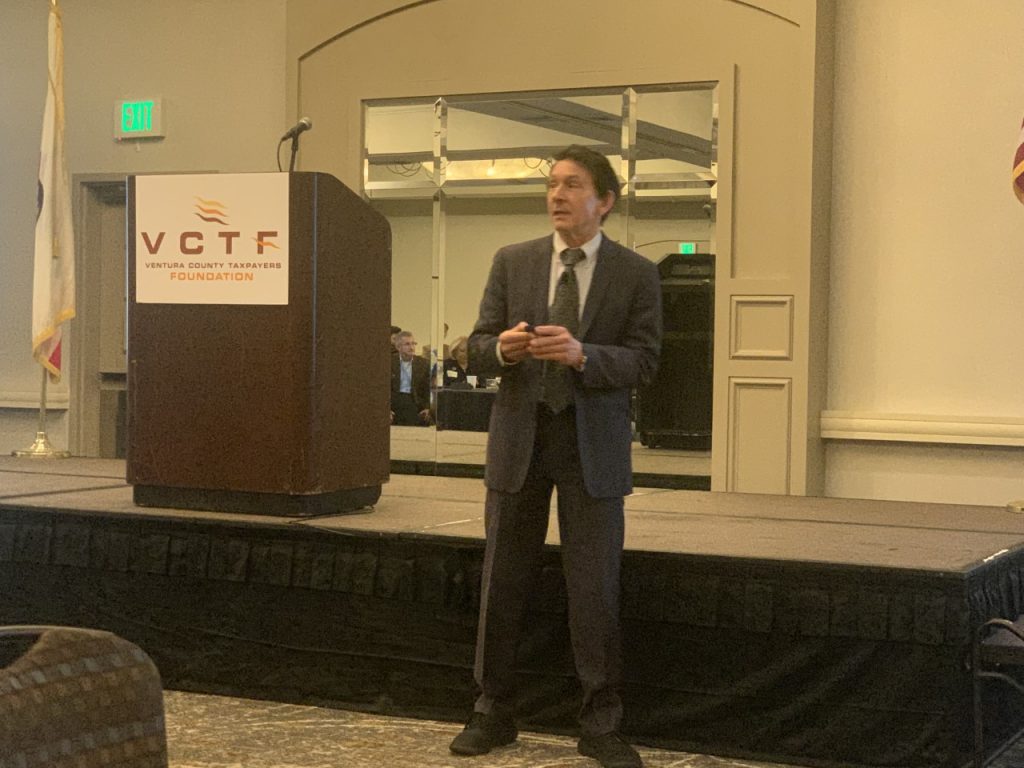

Echoing other local economists, Mark Schniepp told attendees at the Ventura County Taxpayers Foundation’s economic outlook conference on April 14 that the county will see slow growth the rest of this year.

“We have two scenarios,” Schniepp, director of the California Economic Forecast in Santa Barbara, said at the annual event at the Hyatt Regency Westlake Hotel in Westlake Village. “A recession and no recession.

“Either way, it’s very, very slow growth … less than 1%,” he said.

Even if there is no recession, “it will still seem like a recession,” he said. “It’s going to be a tough year.”

Despite the two scenarios, Schniepp told the Business Times prior to his presentation that he believes a recession is inevitable.

“We’ll not avoid a recession,” he said.

But it will likely be shallow and short-lived, he said.

In his presentation, Schniepp said that if a recession does hit, it will do so in the third quarter of this year and continue through the first quarter of 2024.

Ventura County’s growth “will be more sluggish than adjacent counties just like it always has been because we have this SOAR overlay that is kind of hampering it,” he said.

SOAR is a series of voter initiatives that require a majority vote of residents before agricultural land or open space areas in the county can be rezoned for development.

“So that makes the county a bit more vulnerable to having negative growth,” he told the Business Times.

“But for the most part, the county is going to do very much like the rest of the Southern California economy,” he said.

“It will probably avert any kind of labor market calamity,” he said. “Agriculture is doing extremely well. The Port (of Hueneme) is really contributing big time.”

But the office market remains weak because many office workers are still working at home, he said.

In his 2023 Ventura County Economic Outlook report, Schniepp says there are a number of issues that would increase the likelihood of a recession.

They include a banking sector collapse, more than anticipated interest rate hikes, a surge of layoffs where workers remain unemployed, inflation remaining in the five to seven percent range, and a clear erosion in consumer demand and business fixed investments.

“The risk of recession is sharply higher in 2023,” the report says. “The economy is already tipping as a result of (1) inflation, and (2) the aggressive Fed actions to reverse it.

“Inflation is forecast to moderate slowly this year, in line with the pace of disinflation that has occurred over the last six months,” the report says.

Interest rates are forecast to remain high through the rest of 2023.

“Another rate hike on March 22 pushed the (Federal Reserve) funds rate to 5.0 percent,” the report says. “Another hike this year is in the cards, maybe even two.”

Under a recession scenario, employment growth will range between 0.5 and negative 1.0 percent for the year, according to the report.

The increase in the unemployment rate will remain contained, likely not rising beyond 5.0 percent due to limited labor force availability, the report says.

The labor force is unlikely to outpace the demand for workers by Ventura County firms and organizations, simply because the population is in decline, according to the study.

Since 2016, an estimated 40,000 more residents have left Ventura County than new people moving in, the report says.

The county’s population as of July 2022 was 832,605 people, according to the U.S. Census Bureau.

Jobs will be filled by employees who reside elsewhere, namely in the San Fernando Valley, the report says.

“Many professional service and technology jobs will be filled by Ventura County residents, but these jobs are more available in Santa Barbara and Los Angeles Counties,” the report notes.

Elevated job openings will continue to persist in many sectors, notably healthcare and hospitality, according to the study.

As for housing, more “was underway in 2022 and the momentum will carry into 2023 for much of the year,” the report says.

A recession scenario may limit the demand for permits, but because the likely extent of the recession will be relatively brief, and because housing demand will rebound as the economy recovers in 2024, development activity should persist, the report says.

Apartment production will dominate housing development, according to the study.

The weak demand to purchase existing housing due to mortgage rates in the 6% to 7% range has not only reversed home price appreciation, but has also reduced available inventory sharply, the report says.

That’s because sellers do not want to sell their homes in a declining market, the report says.

Prior to Schniepp’s remarks, Jon Coupal, president of the Howard Jarvis Taxpayers Association, addressed the exodus of people and businesses from California because of high tax rates and the high cost of living and doing business.

“You’ve seen the list of businesses, a list about 15 pages long, major corporations moving out of the state of California to other states, really gutting our tax base,” Coupal said.

He said the Public Policy Institute of California had an April 13 blog post that stated, “Our findings suggest that taxes might be a factor in where higher-income people go when they leave the state.”

“And my reaction was, ‘Thank you Capt. Obvious,’” Coupal said to laughs.

[ad_2]

Source link