[ad_1]

Art Wager/iStock Unreleased via Getty Images

Overview

The discussion around Tesla, Inc. (NASDAQ:TSLA) stock has recently focused on elements of its latest Q1 earnings report, namely its ongoing price cuts as well as the company’s overall pivot to a higher volume/lower margin automotive sales strategy. Along with this, there have been references to an autonomous driving future and Tesla’s role within it.

My perspective on the autonomous driving opportunity is that it’s many (15+) years away. While the streets of San Francisco may swarm with driverless vehicles, I foresee that this is the type of technology that will be relatively polarizing for consumers across America as a whole. Most of America isn’t a “tech hub” and most people are not too likely to be comfortable with unmanned vehicles rolling around their neighborhoods. This may be speculative, but it lines up quite well with common sense as well as my anecdotal experience.

As such, I foresee that autonomous driving will progress with a complex trajectory that sees a limited self-driving capability being rolled out state-by-state. This will serve to create a complex legislative situation at the Federal level, akin to what we’re seeing now with cannabis. In the end this will net out to a much longer timeframe to roll out the technology as well as commercialize it. To that end, I am skeptical it will be a material factor on Tesla’s bottom line for at least 15 years.

Furthermore, I think the discussion around Tesla’s automotive division, while warranted, is missing an aspect of Tesla’s business that makes it particularly interesting as a growth stock: energy storage. This article will focus on the opportunity there in particular.

Energy Storage

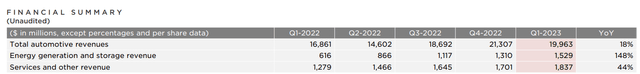

Tesla’s energy storage business has been growing steadily since its inception in 2015 and has recently hit critical mass, generating over $1B in revenue every quarter since Q3 2022. While it was only 6.55% of the company’s overall revenues in the most recent quarter, this represented the largest proportional contribution of this segment yet. The YoY growth figure of 149% shows that the company has a real growth business in its hands.

Tesla’s energy storage offering is actually two-pronged, with both a consumer and commercial offering. Each of them represents a significant market opportunity in its own right.

The consumer offering involves setting up a solar panel on one’s home that subsequently stores energy for future use. This energy can be utilized to do anything from power one’s home to charge your electric vehicle. The total addressable market (TAM) for this would be something in the realm of all consumer electricity expenditure. Some back-of-the-napkin calculations for the U.S. indicate that this is a $300B market in its own right:

|

U.S. Total Households |

123.6M |

|

U.S. Avg Household KwH Usage Yearly |

10,632 |

|

U.S. Avg Household KwH Total |

1.31 Trillion |

|

U.S. Avg KwH Price |

$0.23 |

|

U.S. Household Electricity Market Size Est. |

$301.3B |

Source: Author’s Excel Spreadsheet, U.S. Energy Information Administration.

The commercial (grid-scale) storage solution is also interesting and plainly useful. States that see large fluctuations in electricity prices, such as California, would benefit from this in particular. A documentary from CNBC states that this market was already $3.1B in 2020 and is expected to hit $15.04B in 2027.

This is because grid-scale storage is particularly useful for the ongoing transition to green energy. Unlike fossil fuels, green energy – such as solar – can take a long and variable time to generate specific quantities of energy. This creates a much more significant variability as to energy supply – even though energy demand remains as it was. As such, you need storage if you’re going to leverage clean energy at scale. Otherwise, you will have shortfalls and blackouts when energy supply and demand fail to line up.

Tesla Market Positioning

Tesla is very well positioned to enter and capture a significant portion of the energy storage market because batteries are one of their core competencies. If Tesla had not been a battery innovator in the first place, they would not have been first-to-market with electric vehicles. The company has continued to deepen and broaden this core competency while also beginning to bring it to market via the energy storage business. Elon Musk himself said that the energy market is larger than the automotive one.

This makes Tesla very unique from an automotive perspective. Generally. automotive companies purchase batteries and do not develop them in-house. As such, they are not positioned to capture any portion of the energy storage market, at least not in a way that would be economic. This is now a significant long-term differentiator for Tesla that could very well overtake its core automotive business in the very long-term.

Conclusion

While a perennially expensive stock and one that is currently trading at a 41.64 TTM P/E ratio, I think Tesla, Inc. is uniquely positioned to capture one of the largest growth markets of the next two decades. Just like with the electric vehicle business, it is way ahead of prospective competitors in terms of actually getting something to market. This time, however, it is also a very large company with significantly more resources. This should allow Tesla, Inc. to continue growing this business without too much regard for the competition or for margins – allowing it to eat up market share. In due time, however, I think the energy storage opportunity will yield returns for the company as well as its shareholders, and I’m still bullish on Tesla, Inc.

[ad_2]

Source link