[ad_1]

Just_Super

Investment Thesis

Parsons Corporation (NYSE:PSN) primarily provides digital solutions and services for developing capacities in intelligence, defense, cybersecurity, space and missile, transportation, infrastructure protection, and urban development. The company has recently acquired IPKeys Power Partners, which offers cyber and operational security to North American electric, water, and gas utilities. I believe this acquisition can act as a primary catalyst to boost the company’s growth as it will strengthen its technological capabilities and customer base. In addition, the company has been awarded multiple government contracts, which can help it to sustain its revenue growth.

About PSN

PSN mainly offers digital solutions and services to develop capabilities in the fields of intelligence, defense, cybersecurity, space and missile, transportation, infrastructure protection, and urban development. The company conducts its business in two reportable segments: Federal Solutions and Critical Infrastructure. The Federal Solutions segment serves the US government by providing integrated solutions, engineering services, software, and hardware products. This segment consists of two business units: Engineered Systems (ES) and Defense & Intelligence ((D&I)). The ES business unit offers solutions such as threat analytics, geospatial intelligence, integrated air and missile defense, and space situational awareness. Its customer base mainly includes the Defense of Department, including the National Reconnaissance Office (NRO), the Missile Defence Agency (MDA), and the National Geospatial-Intelligence Agency (NGA). The D&I business unit is divided into three distinct sections: mission solutions, engineering and technical services, and high-consequence missions. Its customers include the US intelligence community, US Cyber Command, the US Department of Defense, and the Department of Justice. D&I is a mission partner supplying differentiated technical solutions, products, and services in space, cyber, multi-domain command and control, missile defense, electromagnetic spectrum dominance, surveillance and reconnaissance, intelligence, and directed energy. This segment contributes 53% to the company’s revenue. The Critical Infrastructure segment focuses on two business lines: Mobility Solutions (MS) and Connected Communities (CC). Its MS division offers engineering, planning, and management services for infrastructure, including dams, reservoirs, water and wastewater, bridges, and tunnels. Its customer relationship includes the states of California, Texas, Washington, Georgia, New York, Colorado, Florida, and New Jersey. The CC business unit comprises environmental remediation, aviation, intelligent transportation systems, a software house, rail and transit, emerging contaminants, and its digital transformation organization, ParsonsX. Its customers include Fortune 100 Companies, state and local governments, the state or provinces of Texas, Ontario, and Georgia, and rail and transit entities, including CSX, AMTRAK, and WMATA. This segment generates 47% of the company’s total revenues.

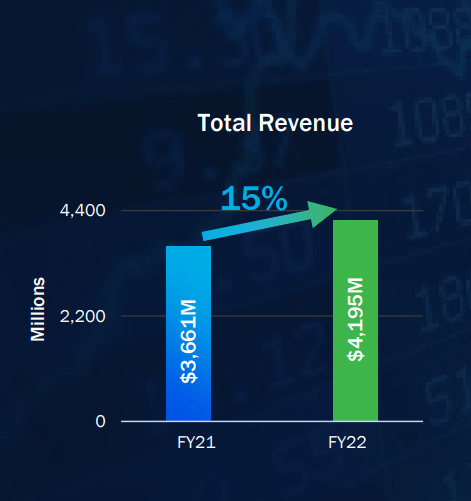

Revenue Growth of PSN (Investor Presentation: Slide No: 8)

Financial Trend

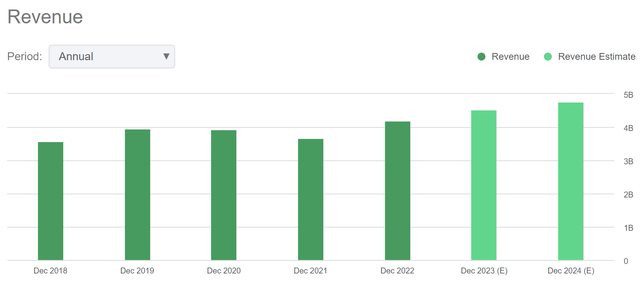

Revenue Trend of PSN (Seeking Alpha)

We can observe in the chart that PSN has maintained steady revenue in the last five years. The company’s revenue has increased from $3.56 billion in FY2018 to $4.20 billion in FY2022, resulting in a 5-year CAGR of 3.36%. The company’s constant revenue growth has resulted from long-term contracts and strong demand in the national security & critical infrastructure market. I believe the company can experience strong revenue growth in the coming year as a result of the acquisition of IPKeys Power and all above mentioned new contracts. The company is still experiencing strong demand in the national security & critical infrastructure market, which can support the demand growth in the coming year. According to the seeking alpha, the company’s revenue for FY2023 might be $4.53 billion, which is 7.86% YoY growth as compared to $4.20 billion in FY2022. I believe the revenue growth of 7.86% perfectly captures the impact of acquisition and the above-mentioned new contracts. The revenue of $4.53 billion will result in a 3-year CAGR of 7.37%.

Acquisition of IPKeys Power

Cybersecurity threats are rapidly rising due to increasing global connectivity, further leading to high investments in cybersecurity software and solutions. It is observed that critical infrastructure is at high risk in terms of security. In addition, the geo-political conflicts have also fueled aggressive cyber-attacks on critical infrastructures. This need for security has significantly accelerated the demand in the industry, creating ample opportunities for the participants. Identifying these opportunities, the company has recently acquired IPKeys Power Partners, which serves North American electric, water, and gas utilities by providing them with cyber and operational security with the help of enterprise software platform solutions. The strategic acquisition strengthens both Parsons’ Federal Solutions and Critical Infrastructure segments, specifically through comprehensive cloud-based cybersecurity, software solutions at the intersection of information and operational technology ((IT & OT)), and technologies that will aid in the global clean energy transition. I believe this acquisition can act as a primary catalyst to boost the company’s growth as it can strengthen its capabilities in two growing end markets that include grid modernization and cyber resiliency for critical infrastructure. This expansion can strengthen the company’s portfolio and expand profit margins as it can increase the company’s customer base significantly. As per my analysis, this growth can sustain for a long time as the cybersecurity market can constantly grow considering the threat scenarios to the critical infrastructure.

Selection for Chester Bridge Design-Build Project

The aging of Global Infrastructure has increased the demand for modernized infrastructure, which I think can be a potential growth opportunity for the company. This demand is reflected in the company’s recent selection for the Chester Bridge design-build project. The Missouri Department of Transportation ((MoDOT)) has selected Parsons Corporation’s Critical Infrastructure segment to join the design-build project for the Bi-State Chester Bridge Design-Build project, which replaces an outdated and aging truss bridge across the Mississippi River between Perryville, MO, and Chester, IL. As a subcontractor to Ames Construction, Parsons will serve as the chief designer to provide a distinctive 4-span, 3-tower cable stay bridge that can reduce the danger to river navigation traffic. The company’s global portfolio includes over 4,500 crossings, including landmark projects that carry pedestrians, railroads, and pipelines. After considering all the above factors, I believe the addition of this project can help the company to strengthen its global portfolio and increase its competitiveness in the market.

State Department Humanitarian Support Contract

The company has been awarded a $750 million contract for three years by the State Department for providing humanitarian support services. The $750 million ceiling value single award contract includes a $250 million base period and a $250 million options period. As per this contract, Parsons will supply global logistics support services, including identification, medical, and transportation needs. This work builds on the company’s existing cooperation with the State Department, which involves offering integrated security systems to over 280 overseas diplomatic missions, including embassies, consulates, and liaison activities with international organizations. This contract can help the company to improve its financial position as it will generate additional fixed revenues for three years. I believe the company can get awarded more such contracts to accelerate its growth as the United States leads the globe in humanitarian help, giving life-saving aid to tens of millions of displaced and crisis-affected people, including refugees.

Federal Aviation Administration Contract

The Federal Aviation Administration (FAA) awarded Parsons Corporation the recompete technical support services contract 5. The $1.8 billion ceiling value contract includes a four-year base period and two three-year option periods to support the FAA’s Aviation System Capital Investment Plan (CIP). The Aviation System CIP includes programs and actions for the National Airspace System (NAS) to develop existing systems and continue the transition to the Next Generation Air Transportation System. Since 2001, the company has provided technical support services to the FAA through Technical Support Services Contract (TSCC) 3 and TSCC 4, with responsibilities including project management, infrastructure modernization, system and equipment installation and testing at over 600 locations, and health, environmental, engineering, and fire protection services. TSSC 5 can help the company to sustain its revenue growth as retention of the client base plays a crucial role in the company’s growth. I believe these long-term contracts can protect the company from the economic slowdown as these contracts guarantee fixed revenue generation for a long period.

What is the Main Risk Faced by PSN?

The company derives a significant portion of its revenue from the United States federal government and its agencies. Contracts with the United States federal government and its agencies accounted for approximately 17% of account receivables as of December 31, 2022, and December 31, 2021, respectively. Government spending on its Critical Infrastructure services may also be influenced by demand-side factors such as the state of existing infrastructure and buildings, as well as the requirement for new or expanded infrastructures and structures. If its government clients confront budget cuts or deficits, it can negatively affect the company’s revenues and reduce its profit margins.

Valuation

The company’s recent acquisition of IPKeys power partners can accelerate its growth by increasing its customer base and strengthening both business segments. In addition, the company has also been awarded contracts from the government, which can help it to sustain its revenue growth. I believe these catalysts can push the stock upwards, and investors can expect a long-term upside. According to the seeking alpha, the company’s revenue for FY2023 might be $4.53 billion, which is $43.64 revenue per share. After considering all the above factors, I think seeking alpha’s estimates justifies the impact of acquisition and new contracts. Therefore, I am $43.64 revenue per share for FY2023, which gives a forward P/S ratio of 0.99x. After comparing the forward P/S ratio of 0.99x with the sector median of 1.29x, I think that the company is undervalued. I believe the company might gain significant momentum due to its recent acquisition of IPKeys Power Partners and new contracts, which can help it to trade at its sector median. Therefore, I estimate the company might trade at a P/S ratio of 1.29x, giving the target price of $56.30, which is a 29.51% upside compared to the current share price of $43.46.

Conclusion

My final thought on Parsons Corporation is that the stock is undervalued at the current share price. After comparing the forward P/S ratio of 0.99x with the sector median of 1.29x, I think that the company is undervalued. Investors can expect a healthy 29% upside as it has recently acquired IPKeys Power Partners, which can accelerate its growth by increasing its technological capabilities and customer base. In addition, it has also been awarded multiple government contracts which can sustain its revenue growth. After analyzing all the above factors, I assign a buy rating to PSN.

[ad_2]

Source link