[ad_1]

Kevin Dietsch

Article Thesis

Meta Platforms, Inc. (NASDAQ:META) has reported strong Q1 quarterly results that have sent its shares soaring. Importantly, Meta’s profitability is looking a lot stronger than feared, and ongoing cost-cutting efforts could improve earnings further. That being said, following a massive rally year-to-date, Meta Platforms is not the value pick it was a couple of months ago.

What Happened?

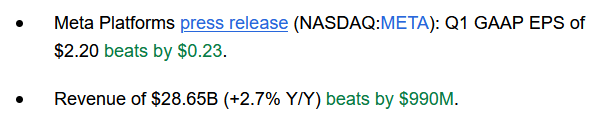

Meta Platforms, Inc. reported its first-quarter earnings results on Wednesday afternoon. The company managed to outperform expectations easily on both lines:

Seeking Alpha

Revenues rose by 3% year-over-year, which was stronger than expected, as the analyst community was expecting a small top-line decline. Meta also beat earnings per share expectations by more than 10%, which was a very strong feat, as its profitability had been a focus point by investors in the recent past.

The market liked these results very much, sending Meta Platforms’ shares up by 10% at the time of writing. That makes for a new 52-week high in after-hours trading, although it is not guaranteed that this will hold true throughout Thursday, as Meta Platforms, Inc. shares could remain volatile.

Back To Growth

Meta Platforms had been a growth company for many years, but this changed in the recent past. A combination of currency rate headwinds, tough comparables, and a slowdown in ad markets due to a tough macro environment has resulted in a rather weak business growth performance in recent quarters, as Meta reported sales declines in the mid-single digits for the last two quarters of 2022. Expectations thus weren’t very high for the most recent quarter, Q1 2023, but Meta showed that the turnaround is working and that it has gotten back on the right track.

While 3% year-over-year growth in its revenues doesn’t sound too strong in absolute terms, that’s a huge improvement versus the 5% revenue decline that Meta experienced during the previous quarter, Q4 2022.

Also, the top-line number was negatively impacted by currency rates. As a company that is active around the globe, Meta Platforms is highly exposed to changes in currency markets, but these are, of course, not controllable by the company. In some quarters, currency rates are a tailwind for META’s reported results (when the U.S. Dollar is getting weaker), while currency rates are a headwind during times when the U.S. Dollar is strengthening. That has been the case over the last year, which is why Meta’s revenues were facing a 3% headwind from currency rate movements. At constant currencies, Meta would have reported a 6% revenue increase, which is not outstanding, but very solid, I believe.

Since Meta’s underlying performance was quite positive, and since currency rate movements won’t be a headwind forever – the U.S. Dollar has started to weaken again in recent months – investors can be quite happy with the business growth performance Meta Platforms has delivered during the first quarter of the current year. Since momentum is strong and since currency rates should be less of a headwind in Q2 and H2, I believe that there is a good chance that reported revenues will be stronger during the remainder of the year.

Importantly, Meta also delivered solid results when it comes to its underlying user metrics: Both its family daily active people and its family monthly active people metrics were up 5% year over year, showing that Meta’s different platforms are still highly important for users around the world, and actually growing in importance. The threat by TikTok and Snap Inc.’s (SNAP) Snapchat seemingly isn’t very pronounced, or at least that’s what the growing user count suggests. With its user count still climbing, there is a good chance that Meta will be able to deliver solid long-term revenue growth, although ad rates will have an impact as well.

In the recent past, Meta’s performance has been quite questionable when it comes to its profitability levels. Like many other tech companies, Meta was overspending during the good times, e.g., by hiring at a rapid pace. As revenue growth slowed down (and actually turned negative during Q3 and Q4 of 2022), the higher expenses suddenly had a huge impact on Meta’s profitability, and both its margins and its reported earnings per share slumped.

While margins were still down on a year-over-year basis during the most recent quarter, things are clearly improving:

Meta’s operating margin was 20% during the fourth quarter, as expenses had been up by 23% on a year-over-year basis. During the most recent quarter, Meta’s operating margin came in at 25%, and expenses were up by 10% compared to the previous year’s quarter. While investors want to see expenses grow less than revenues, which has not been the case during Q1 yet, things are, I believe, clearly improving. Expense growth has been reigned in while revenue growth has picked up over the same time. On a sequential basis, margins improved substantially, and that was possible despite the fact that Q4 generally is a stronger quarter compared to Q1, due to the seasonal holiday effect.

If Meta Platforms keeps moving in the right direction, i.e., reigning in expense growth via headcount reduction efforts, office space optimization, and so on, then there is a good chance that margins will improve further. I also wouldn’t be surprised to see Meta deliver cost growth that is below its revenue growth during the latter half of 2023. After all, Meta is not standing still when it comes to cost reduction efforts – the company has announced several rounds of headcount reductions already, including during March 2023. The full impact of those cost savings was not yet accounted for during Q1, thus the positive margin impact should be stronger in the upcoming quarters.

Importantly, Meta’s expenses during the first quarter included one-time charges for its office space and headcount optimization efforts. Those totaled $1.1 billion, or around 5% of Meta’s total expenses. Without these one-time expenses, Meta’s costs would have been up by just 5% year-over-year, and its operating margin would have been substantially higher, at close to 30%.

While the report was not perfect, and while profits are still below the peak levels seen in the past for now, there were thus, overall, many things to like in Meta’s Q1 report. Apart from the fact that business growth has picked up again, the cost reduction efforts are clearly having a positive impact on profitability already, and these efforts should pay off even more in the current quarter and beyond, as additional job cuts will have a more pronounced impact and since one-time expenses should decline compared to the high charges seen in Q1.

Is META Stock A Buy?

Due to the reasons shown above, I believe that investors can be very happy with Meta’s operational performance during Q1. The outlook for the foreseeable future is also positive, I believe, as revenue growth momentum is positive and since further margin improvements are (likely) on the horizon.

But that does not necessarily mean that Meta Platforms, Inc. stock is a great buy today – after all, valuations should be considered, too. While Meta Platforms does not look very expensive in absolute terms, trading for around 23x forward profits at the time of writing, this also isn’t a bargain valuation.

This is especially true when we compare Meta’s current valuation to how the company was valued over the last year. At the lows of around $90, Meta was trading for just 9x this year’s expected net profits – that’s when Meta was a great buy. Today, following a massive 170% share price gain from the 52-week low, shares are significantly less attractive. While Meta does not look unreasonably expensive, with a solid long-term outlook, a great market position, and a fortress balance sheet, it also isn’t a pound-the-table buy like it was a couple of months ago.

I own shares in Meta Platforms, Inc. and am very happy with the recent results and developments. However, at well above $200, I’m currently not looking to increase my Meta Platforms, Inc. stock exposure further. Others may disagree – I’d be happy if you share your perspective in the comment section below.

[ad_2]

Source link