[ad_1]

emptyclouds/E+ via Getty Images

Investment Thesis

McGrath RentCorp (NASDAQ:MGRC) rents relocatable modular buildings, portable storage containers, electronic test equipment, and liquid & solid containment tanks & boxes. The mobile modular and TRS-RenTelco segments are showing strong demand for MGRC’s products. The business is also acquiring new businesses to broaden its geographic reach in new markets.

About MGRC

MGRC is a diversified business-to-business rental organization that offers rental divisions such as relocatable modular buildings, portable storage containers, electronic test equipment, and liquid & solid containment tanks & boxes. It has a diverse customer base of nearly 23,000 customers. The company conducts its business in four reportable segments: Mobile Modular, TRS-RenTelco, Adler Tanks, and Enviroplex.

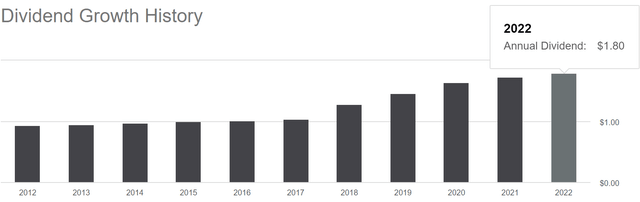

The Mobile Modular & Enviroplex segment consists of all relocatable modular buildings. It jointly contributes 66.07% to the company’s total revenue. The TRS-RenTelco segment includes all the electronic test equipment and contributes 20.54% to the company’s total revenues. The Adler Tanks segment consists of liquid & solid containment tanks & boxes. This segment generates 13.37% of the company’s total sales. The company paid an annual dividend of $1.80, representing a dividend yield of 2.08%. The dividend payout reflects the well-positioning of the company in the market. The company concluded an equity sale agreement with Ironclad Environmental Solutions, Inc. on February 1, 2023, to sell its Adler Tanks Business for $265 million, subject to certain adjustments. Concurrently, the company executed a stock purchase agreement to acquire Vesta Modular for $400 million, subject to certain adjustments. The sale of the company’s Adler Tanks business and the equity purchase of Vesta Modular signal a strategic shift in the company’s activities to focus on its core modular & storage business. This shift can potentially boost the company’s growth of its modular business and facilitate cost and revenue synergies.

Dividend Growth History of MGRC (Seeking Alpha)

Acquisition of Vesta Modular

The company is also targeting new acquisitions to expand its footprint in new locations and strengthen its position in existing locations. Recently, the company acquired Vesta Modular for $400 million. The addition of Vesta Modular has expanded the company’s product line and provided access to many new geographies. This acquisition is part of the mobile modular segment. This acquisition can also help MGRC to expand its profit margins as Vesta Modular’s operations synergize perfectly with MGRC’s operation. This acquisition can give a boost of $129 million to MGRC’s annual revenue, which can increase McGrath’s modular sales mix from 66% to 80%.

Joe Hanna, President and CEO of McGrath, stated

Growing Mobile Modular is the strategic focus area for our company, and the addition of Vesta’s portfolio accelerates our expansion of the business. We are now able to offer our customers access to an expanded product line across more geographies than ever before. We are confident we will be able to leverage our combined sales and operational resources by seamlessly integrating Vesta in order to grow the new, larger scaled McGrath modular business together. In addition, Vesta has a dedicated and experienced team, and we are excited to welcome these new team members into the McGrath family.

Acquisition of Dixie Temporary Storage & Brekke Storage

The modular container market has experienced tremendous growth in the past few years as it comes with a broad range of benefits, including storage security, cost-effectiveness, and quick & easy installation. These rental containers are also widely used for expanding office spaces on construction sights. In addition, it is also highly used by retailers, manufacturers, municipalities, contractors, and individual households. This wide usage represents a potential growth opportunity in the industry. Identifying these opportunities, the company has announced the acquisition of the assets of Dixie Temporary Storage, a regional company that provides portable storage solutions covering the markets of South Carolina. McGrath’s revolving credit facility was used to finance the deal. McGrath’s portable storage operations will gain about 800 assets and a new branch location as a part of this acquisition. This acquisition has enabled the company to expand its geographic footprint in the South Carolina market by acquiring fleets and increasing its asset base. I believe this acquisition can boost the company’s growth in the coming period as it can significantly help the company to capture the regional market share of South Carolina. This acquisition can expand the company’s revenue and profit margins as Dixie Temporary Storage perfectly complements MGRC’s portable storage rental business. Dixie Temporary Storage can potentially help MGRC to strengthen its position in the competitive markets as this acquisition is creating an entry point for MGRC to enter the South Carolina market, which can increase its customer base. The company has also acquired Brekke Storage, a local retailer in the Colorado area, for portable storage solutions. This acquisition can strengthen MGRC’s position in the Colorado area as MGRC’s portable storage operations gain 2,700 additional assets and a new branch site with this acquisition. As per my analysis, the demand growth in the container market can sustain for a longer period as industrial and commercial growth is constantly booming due to rapid urbanization in all the cities.

Financial Trends and Rising Demand

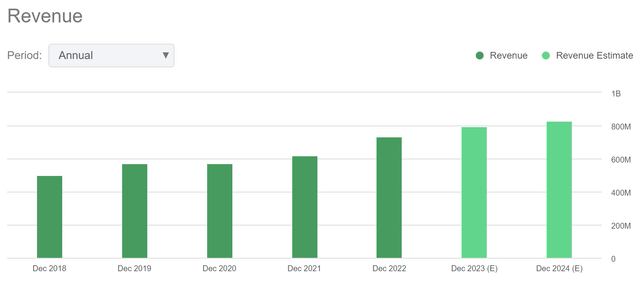

Revenue Trends of MGRC (Seeking Alpha)

We can observe in the above chart that the company has experienced steady growth in the last five years. The company’s revenue has increased from $498.33 million in FY2018 to $733.82 million in FY2022, resulting in a 5-year CAGR of 8.05%. The company is currently experiencing strong demand in the Mobile Modular segment. I believe the company can continue this growth in the coming years as the US government has announced that they are planning to invest $864 billion investment in the country’s infrastructure which can act as a tailwind for generating demand in MGRC’s mobile modular segment throughout the company’s geographical footprints and balancing out any potential effects of a weaker economy. Even the company’s management has stated in a recent conference call of Q4FY2022 that they are expecting the federal fund to act as a tailwind for the mobile modular segment. TRS-RenTelco segment has a long-term positive driver of the 5G network. However, MGRC is also targeting new opportunities in aerospace and defense markets, which can expand the demand for the TRS-RenTelco segment.

According to MGRC’s management, the company’s revenue for FY2023 might be in the range of $780-$810 million, which is 6.29%-10.38% YoY growth. After considering the company’s recent acquisitions and rising demand in the mobile modular & TRS-RenTelco segment, I believe 10.38% YoY growth is justified. Therefore, I estimate that MGRC’s revenue for FY2023 might be $810 million. The company’s 5-year average net profit margin is 16%. I think the company can sustain the 5-year average net profit margin with the help of rising demand and customer base. That is why I estimate a net profit margin of 16% for FY2023, which gives an EPS of $5.31.

What is the Main Risk Faced by MGRC?

The company pays labor costs and purchases raw materials such as lumber, siding, roofing, and other products to make periodic repairs, changes, and refurbishments to keep its modular units in good physical condition. The amount, timing, and type of maintenance and repair work on its rental equipment may vary from quarter to quarter and year to year. If the labor cost or the cost of raw materials increases, it can highly increase the acquisition cost for new modular units and affect its operating cost. This increase in cost levels can negatively affect the company’s financial performance and further contract its profit margins.

Valuation

MGRC is experiencing solid demand in the mobile modular and TRS-RenTelco segment. The company is expanding its geographical footprint in new markets by acquiring new companies. I believe this rising demand and new acquisitions can significantly boost the company’s financials in the coming year. These growth factors can push the stock upwards, and we can expect a long-term upside as the demand can sustain for longer periods due to rapid urbanization. After considering all the above factors, I am estimating revenue of $810 million and a net profit margin of 16% for FY2023, which gives an EPS of $5.31. The EPS of $5.31 for FY2023 gives the forward P/E ratio of 16.23x. The company’s forward P/E ratio of 16.23x is almost the same as the sector median of 16.30x, which shows that MGRC stock is fairly valued at its current share price of $86.19. However, MGRC has a tendency to trade significantly above its sector median as the company’s 5-year average forward P/E ratio is 18.85x, which is 13.9% lower than the forward P/E ratio of 16.23x. I believe the company can gain momentum and trade at a 5-year average P/E ratio in the coming year with the help of rising demand and new acquisitions. Therefore, I conclude that the company is undervalued at its current share price. The EPS of $5.31 and 18.85x gives the target price of $100.1, representing an upside of 16.14% from the current share price of $86.19.

Conclusion

The company has been experiencing healthy levels of demand, which is reflected in its past performance and strategic plans. I believe the company can experience tremendous growth in the mobile modular and TRS-RenTelco segment in the coming quarters. MGRC can also extend its geographic reach into new regions by purchasing new businesses. It can suffer a financial loss if the cost of labor and raw materials increases. The company is currently undervalued, and we can expect a healthy 16.14% in the stock from the current price levels. After analyzing all the above factors, I assign a buy rating to MGRC stock.

[ad_2]

Source link