[ad_1]

I going to make a greatest artwork as I can, by my head, my hand and by my mind.

This is the third in a series of blog posts where I take a detailed look at how I’m investing in quality dividend stocks for long-term income and growth.

In the last post, I covered the importance of investing in companies with a track record of consistent profits and dividends, but consistency alone is not enough. Unless a company can grow its dividend ahead of inflation then, over time, the purchasing power of that dividend will decline.

This means that in addition to consistent profits and dividends, I always look for high-quality dividend growth that consistently beats inflation.

High-quality dividend growth can be broken down into three components – sustainability, speed and consistency – and in the rest of this post I’ll show you how to identify and measure all three.

How to identify sustainable dividend growth

It is important to remember that dividends don’t appear out of thin air. Instead, they’re paid out of earnings, so if a company grows its dividend every year but never grows its earnings, at some point further dividend growth will become impossible. In other words, dividend growth is unsustainable without earnings growth.

In exactly the same way, earnings also don’t appear out of thin air. Earnings are what’s left over from revenues after expenses have been deducted, so earnings growth without revenue growth is also unsustainable over the long term.

We can take this line of thinking a step further, because a company cannot generate revenues unless it has some assets, whether that’s inventory (goods that are ready to be sold), raw materials (that will be turned into finished goods), property (such as shops and factories), cash in the bank or any other assets that are recorded on the balance sheet.

If you’re not sure what a balance sheet is, I suggest you read this concise overview of the three main financial statements: UK Financial Statements Overview. Alternatively, here’s a whistle-stop tour of the balance sheet:

- Balance sheet – Summarises a company’s liabilities and assets:

- Liabilities are sources of funding that companies use to generate profits for shareholders. For most companies there are three main sources of funding: Shareholders, lenders and landlords.

- Assets are what those funds are used to buy in the pursuit of profit. They can be grouped into fixed or non-current assets (like property or machinery that will last more than a year) and current assets (like inventory or raw materials that will last less than a year).

Given that companies cannot generate revenue without assets, it follows that companies cannot sustainably grow their revenues, earnings and dividends over the long term without sustainably growing their assets.

And since assets are mostly funded by shareholders, lenders and landlords, it follows that asset growth will usually have occurred because the company raised additional funding from one or more of those sources. However, only one of the three is a truly sustainable source of funding for long-term growth.

Lease-driven growth is not sustainable

Imagine a clothing retailer that wants to grow its assets primarily through additional funding from landlords. It does this by renting more stores, which results in a right-of-use asset and a related lease liability on the balance sheet.

One consequence of leasing rather than owning stores is that much of the revenue from those stores will go to landlords as rent rather than to shareholders as profit. Unfortunately, the rent for each store is fixed, whereas the revenue from each store goes up and down with the economy.

When the good times are rolling, the company’s revenues are high and this leaves plenty of profit for shareholders after rent and other expenses are deducted. However, when the next recession rolls around, its sales fall by 50% but its rental payments remain unchanged, so the company’s profits quickly turn into losses.

This combination of variable revenues and relatively fixed rents has pushed many lease-heavy retailers into losses and bankruptcy in just about every recession you can think of, so lease-driven growth is usually risky and unsustainable.

Debt-driven growth is not sustainable

Let’s imagine that the previous company used funding from lenders rather than landlords. In that case, it would raise funding through loan agreements rather than lease agreements and it would end up with a property asset and a borrowings liability on the balance sheet.

Despite these differences, the company would still end up with a relatively fixed expense, this time in the form of debt interest rather than rent payments. The effect, however, would be almost identical.

Revenues would go down in a recession while interest payments remain relatively fixed, and this combination of variable revenues and relatively fixed debt costs is why so many highly indebted companies go bust at the first whiff of an economic slowdown. So, as with lease-driven growth, debt-driven growth is also risky and unsustainable for most companies.

Equity-driven growth is sustainable

Last but not least, we have asset growth driven by funding from shareholders, which is known as shareholder equity.

The first point to make is that a company’s earnings belong to its shareholders, so if a company retains some of its earnings to fund expansion rather than paying those earnings out as dividends, that funding has effectively come from shareholders.

If the previous company grew its assets by purchasing stores with retained earnings rather than leasing stores or buying them with borrowed money, there would be no fixed rent or interest expenses and that would massively de-risk the business.

Although revenues would still fall during a recession, there would be no fixed rent or interest payments dragging the business down. Meanwhile, other expenses, such as the cost of goods sold or staff costs, could be reduced to maintain profitability. And in a worst-case scenario, the dividend could be temporarily cut or suspended to support the long-term viability of the business.

This flexibility is why funding from shareholders is the most sustainable form of funding, which means that unlike funding from landlords or lenders, it can be used as the main driver of growth over many decades without making a company fragile.

Of course, most companies do use some funding from landlords and lenders and that’s fine, up to a point, but if you’re looking for sustainable dividend growth then it should be driven, ultimately, by the growth of shareholder equity.

What is shareholder equity?

In case you’re not familiar with the mechanics of shareholder equity, it’s similar to the net asset value of a business, which is the value of all the assets minus the value of all the liabilities.

In that sense, it’s very similar to homeowner equity.

For example, let’s say you own a house and it’s worth £3 million. You also have a £1 million mortgage. If you sold the house for £3 million, you could pay off the £1 million mortgage and keep the remaining £2 million (ignoring fees and taxes), so that £2 million is your homeowner equity.

This is why I tend to think of shareholder equity as a rough estimate of the liquidation or break-up value of a business. In other words, if you sold off all of a company’s assets (all of its inventory, its machinery, property and so on) in an orderly fashion, and if you used the proceeds to pay down all of its debts, the amount left over would belong to shareholders.

This is another reason why we want to see the value of shareholder equity going up.

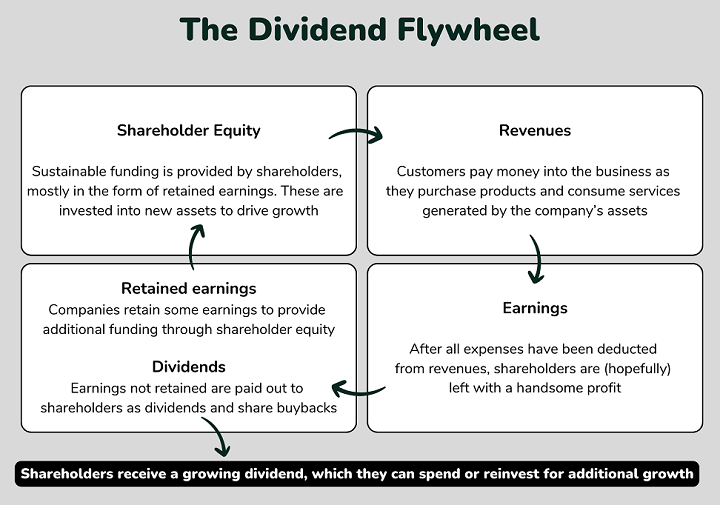

The four spokes of the sustainable dividend growth flywheel

We now have four factors that drive sustainable dividend growth, and they operate very much like a flywheel.

- Equity: Sustainable funding is provided by shareholders, mostly in the form of retained earnings. These are invested into new assets to drive growth

- Revenues: Customers pay money into the business as they purchase products and consume services generated by the company’s assets

- Earnings: After all expenses have been deducted from revenues, shareholders are (hopefully) left with a handsome profit

- Retained earnings and dividends: Companies retain some earnings to provide additional funding through shareholder equity. Earnings not retained are paid out to shareholders as dividends and share buybacks (which are a special type of dividend)

This is a simplistic model and it ignores a lot of detail, but from my perspective as a dividend investor, it captures the main drivers of sustainable long-term dividend growth.

How to identify inflation-beating dividend growth

At the very least, I want my dividends to keep up with inflation, so when I analyse a company, I’m looking for inflation-beating dividend growth that is supported by inflation-beating growth across shareholder equity, revenues and earnings.

I’m a long-term investor and I’m interested in long-term growth, so I always measure growth over the last ten years at the very least. Gathering that much data by hand can be a pain, which is why I use a paid service (SharePad) to do this donkey-work for me.

One problem with measuring growth over ten years is that the result will depend, to a great extent, upon how the company was doing in just two of the ten years (years one and ten). If the company’s results were unusually good or bad at the start or end of the ten-year period, that could have a misleading impact on the calculated growth rate.

To get around that problem, or at least reduce it, Ben Graham (mentor to the world’s most famous investor, Warren Buffett) proposed the following:

- Instead of measuring growth between years 1 and 10, calculate the average result for years 1, 2 and 3 and do the same for years 8, 9 and 10. Then, calculate the growth rate between those two averages.

Using this method, the growth rate will be based on six out of the ten years, instead of just two years, so the general growth trend will have more impact on the result than the ups and downs of any single year.

Having used this approach for many years, I’ve found that earnings are still too volatile to be a consistently useful growth rate measure, so my current approach is to measure a company’s growth rate across its equity, revenues and dividends, as these tend to be far more stable than earnings.

Let’s work through a quick example so you can see how this works.

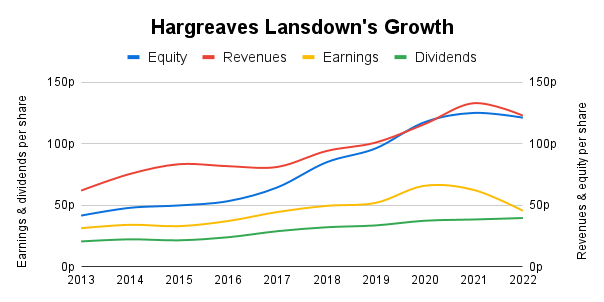

Measuring Hargreaves Lansdown’s Growth Rate

Here’s a chart showing Hargreaves Lansdown’s (OTCPK:HRGLF)(OTCPK:HRGLY) equity, revenues, earnings and dividends per share over the last decade.

If you haven’t heard of Hargreaves Lansdown, it is by far the largest retail investor platform in the UK and it’s currently one of 23 dividend stocks in my portfolio.

I don’t want to get too bogged down in the numbers, so I’ll just summarise the results of my calculations here. If you’re interested in the gritty details, have a look at my company review spreadsheet where you’ll find some other examples.

| Per share results | 2013-2015 Average | 2020-2022 Average | Growth rate |

|---|---|---|---|

| Equity | 47p | 121p | 14.7% |

| Revenues | 74p | 124p | 7.7% |

| Dividends | 22p | 39p | 8.7% |

| Growth Rate | 10.4% |

Hargreaves Lansdown’s Growth Rate

The table tells us that Hargreaves Lansdown has grown its equity, revenues and dividends per share by an average of 10.4% per year over the last decade. I call this number the Growth Rate and it gives me a single figure that I can use to quickly compare lots of different companies.

10.4% is very good and it easily exceeds my rule of thumb, which is designed to exclude companies that have failed to keep pace with the Bank of England’s inflation target:

- Rule of thumb: Only invest in a company it its Growth Rate is above 2%

In addition to that rule, I like to label certain metrics as Good, Okay or Bad to further simplify the task of comparing lots of companies. Here’s how I break this down for the Growth Rate metric:

- Good = Over 5%

- Okay = between 2% and 5%

- Bad = Below 2% (i.e., below the Bank of England’s inflation target)

Anything above 5% is Good because that’s the target dividend growth rate for my portfolio (excluding reinvested dividends), Bad is anything below inflation (2%) and Okay is the grey zone in between.

Another thing to keep in mind is that although the overall Growth Rate number is useful, it is still important to keep an eye on the growth rate of each component (equity, revenues and dividends), because a company’s sustainable growth rate will eventually be limited by its weakest link.

For example, in Hargreaves Lansdown’s case, its revenue growth rate over the last decade was 7.7% per year. While that still falls into my Good range, if revenue growth stays around that level for the next decade or two, it will be hard for the company to increase its earnings or dividends at anything like the headline Growth Rate figure of 10.4%.

How to identify consistent dividend growth

In addition to sustainable dividend growth and inflation-beating dividend growth, I want consistent dividend growth.

One simple way to measure the consistency of dividend growth is to count how many times the dividend went up in the last ten years. The more often the dividend went up, the more consistent its growth was.

Consistent dividend growth is nice, but what I really want to see is consistent growth across the entire dividend flywheel, and that means consistent growth across equity, revenues, earnings and dividends.

So, in addition to counting how many times the dividend went up, I also count how many times equity, revenues and earnings went up. The result of all this is another bespoke metric that I call Growth Quality.

Here’s a quick example of how this works.

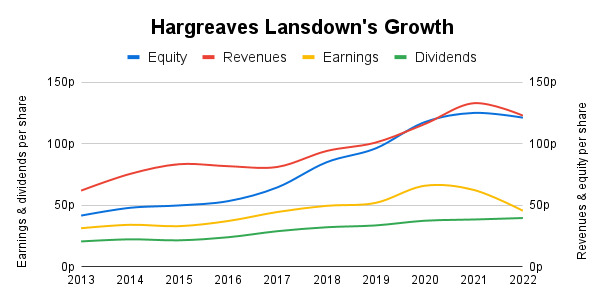

Measuring Hargreaves Lansdown’s Growth Quality

Once again, here are Hargreaves Lansdown’s results over the last decade.

You can tell, just from looking at the chart, that Hargreaves Lansdown has grown its dividend very consistently over the years, supported by steady growth of shareholder equity, revenues and earnings, so I would expect its Growth Quality score to be very high.

The Growth Quality score counts how many times equity, revenues, earnings and dividends per share went up, and displays them as a percentage of the maximum number of times they could have gone up. In other words, if everything went up every single year, the company’s Growth Quality would be 100%.

Here are the results for Hargreaves Lansdown (again, if you want to see the mechanics, have a look at my company review spreadsheet).

| Per share results | Increased | Maximum | As % of max |

|---|---|---|---|

| Equity | 8 | 9 | 89% |

| Revenues | 6 | 9 | 66% |

| Earnings | 6 | 9 | 66% |

| Dividends | 8 | 9 | 89% |

| Growth Quality | 28 | 36 | 78% |

Hargreaves Lansdown’s Growth Quality

78% is a good Growth Quality score and it easily exceeds my rule of thumb.

- Rule of thumb: Only invest in a company if its Growth Quality is above 66%

The 66% cut-off means that, on average, a company should have seen its equity, revenues, earnings and dividends increase at least twice as often as they decreased, and I think that is a reasonable minimum standard for a relatively defensive dividend growth stock.

As with Growth Rate, I categorise Growth Quality as Good, Okay or Bad:

- Good = Above 75%

- Okay = Between 66% and 75%

- Bad = Below 66%

To be marked as Good, a company’s Growth Rate needs to be above 75%, which means its equity, revenues, earnings and dividends went up, on average, three times as often as they went down.

Hargreaves Lansdown meets that standard, so in addition to having a Good Growth Rate, Hargreaves Lansdown’s Growth Quality is also Good, and that’s partly why it’s in my portfolio.

The holy grail of consistent, sustainable, inflation-beating dividend growth

In summary then, dividends need to grow to maintain their purchasing power, but how they grow is important. I want to see growth that is sustainable, inflation-beating and consistent, which requires growth across the dividend flywheel, which includes shareholder equity, revenues, earnings and dividends.

Although sustainable growth driven by retained earnings is what I’m looking for, if a company cannot generate attractive rates of return on those retained earnings, they should instead be paid out to shareholders as dividends. At least that way, shareholders are given the opportunity to reinvest those dividends elsewhere at higher rates of return, or to spend them as they see it.

With that in mind, in the next part of this series I’ll look at return on equity and return on capital, how I measure them and why they’re important indicators of a company’s competitive strength.

Last but not least, here are those rules of thumb one last time:

- Rule of thumb: Only invest in a company if its Growth Rate is above 2%

- Rule of thumb: Only invest in a company if its Growth Quality is above 66%

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link