[ad_1]

sankai

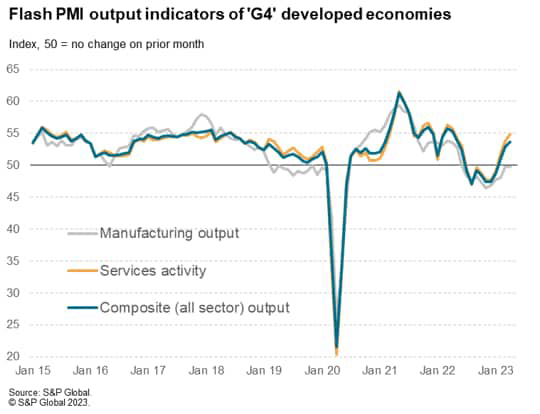

Economic growth across the four largest developed economies has accelerated to the fastest for 11 months in April, according to early ‘flash’ PMI data compiled by S&P Global. Growth is unbalanced, however, being driven entirely by services, as manufacturers continue to struggle amid falling demand.

The skewed nature of growth, and likely delayed impact of higher borrowing costs, lends caution to the interpretation of the stronger data and suggests that growth could falter as the year proceeds, especially if interest rates continue to rise.

The possibility of higher interest rates is meanwhile enhanced by a stubbornly high inflationary pressures in April, especially within the service sector.

Economic growth revival driven by services

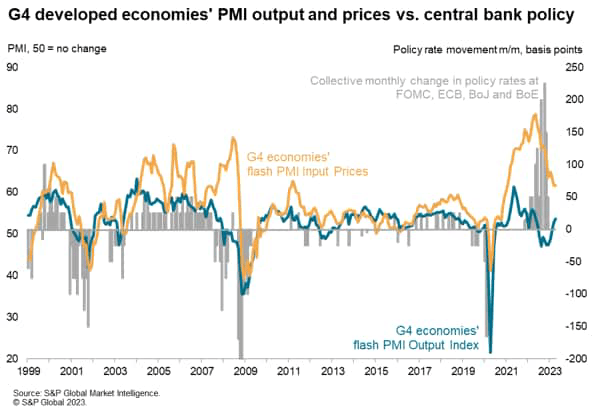

Business activity rose across the four largest developed world economies (the “G4”) for a third successive month in April, according to provisional ‘flash’ PMI data, the rate of growth now the fastest since last May. The acceleration in growth represents a contrast to the seven-month decline that began in July 2022.

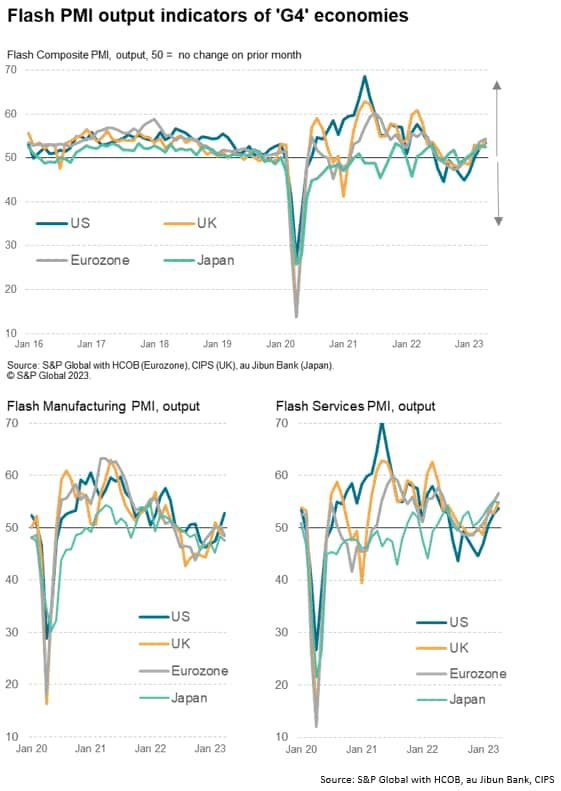

Growth was recorded in all four economies for a third straight month, indicating a further broad-based improvement geographically. Growth hit 11-month highs in both the US and the Eurozone and a 12-month high in the UK. Although growth slowed slightly in Japan, it was nevertheless the second-fastest recorded over the past ten months.

Growth was by no means broad-based by sector, however, with an increasingly strong upturn in service sector activity contrasting with a further decline in manufacturing when measured across the G4. Service sector activity grew across the G4 at its sharpest rate of a year, hitting 12-month highs in the US and UK, an 11-month high in the Eurozone and running at the third-fastest pace ever recorded by the Japanese PMI survey, albeit down fractionally on March.

Manufacturing output meanwhile fell for a tenth successive month in April, dropping in all four economies bar the US, where a modest gain was reported (the largest for 11 months). Rates of manufacturing decline in fact steepened in the UK and Japan, and the eurozone saw factory output fall back into decline after two months of marginal growth (albeit part-linked to strikes in France).

Diverging demand conditions

Strong variations were also seen in terms of demand. Whereas inflows of new business across the G4 service sector grew at the sharpest rate for a year, rising at increased rates in all four economies, new orders at factories fell for an eleventh straight month, the rate of decline remaining solid (albeit the slowest since last June). Only the US saw an increase in new orders for goods, and even here the rise was only modest.

The survey data therefore add to signs that 2023 is seeing a growing shift of spending away from goods towards services, with a notable expansion evident in consumer-facing services and in travel and tourism. This likely reflects the further reopening of the global economy (most recently with relaxed COVID-19 containment measures in mainland China), which for the first year since 2019 allows unfettered travel. Though companies also linked the expansion to improved consumer and business sentiment, in turn associated with improved supply chains, reduced recession risks and lower energy prices, as well as signs that inflation is peaking around the world and therefore the interest rate cycle is likely to turn soon.

Resurgent growth has also been especially evident in financial services compared to the steep declines recorded headed into last winter, attributable to an easing of financial conditions.

Price pressures cool in manufacturing

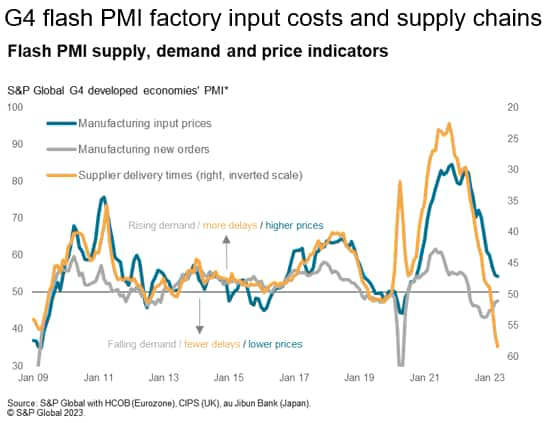

Better news on inflation came from the manufacturing sector, where across the G4 input costs rose at the slowest rate since September 2020, the rate of inflation having cooled sharply since its recent peak one year ago. Lower price pressures were linked to improving supply chains, handing bargaining power back to purchasing managers at factories. Supplier delivery times improved across the G4 to the greatest extent since comparable data were available in 2007, reflecting falling demand for inputs (exacerbated by further evidence of destocking) as well as reduced logistical issues that had arisen during the pandemic.

Record delivery times improvements were seen in the US and Eurozone, while the UK saw the third-largest improvement in the history of the survey following a record shortening of lead times in March. Japan meanwhile saw the fewest supply delays since the start of the pandemic.

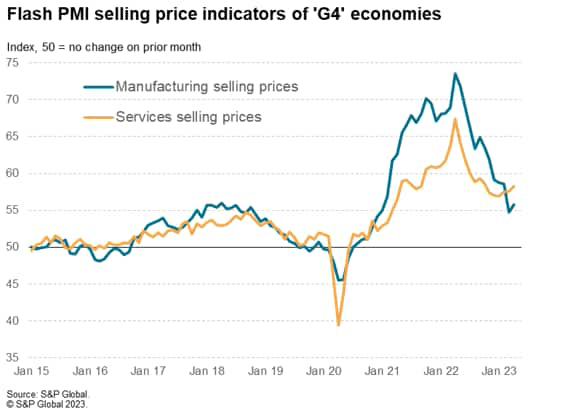

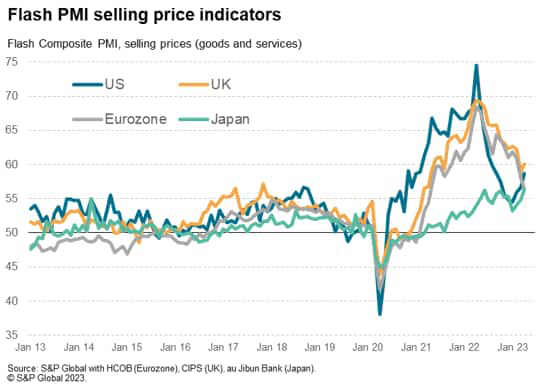

However, factory selling prices rose at an increased rate across the G4, led by Japan and the US, as firms were often better able to pass recent cost gains on to customers. Although the rate of increase remained far lower than the gains seen throughout last year, most notably in Europe, the increase is clearly a concern.

Service sector inflation picks up

Higher price pressures were also seen in the service sector. Prices charged for services across the G4 service sector rose at the fastest rate for six months, the rate of increase having accelerated now for three straight months. Sharper rates of service sector inflation were seen in the US, UK and Japan.

Cost growth in the G4 services sector also ticked higher. Whereas manufacturing cost growth was generally alleviated by easing supply constraints, the survey responses pointed to the opposite in the service sector, with companies and their suppliers struggling to meet the recent upturn in demand. A key input constraint here is of course labour availability.

Combined goods and services selling price inflation across the G4 consequently rose, pointing to a modest upturn in price pressures during the month.

Sustainability in question

The April flash PMI data therefore point to faster economic growth across the four major developed economies at the start of the second quarter, alleviating concerns over imminent global recession risks. However, while detailed sector data are scant at present, there is evidence that the upturn appears to be highly concentrated not just in services but in certain areas of the services economy, namely consumer services and financial services. This reflects a likely tailwind from the pandemic as spending moves from goods to services, as well as some easing of financial conditions after the tightness seen late last year. These factors are likely to act as diminishing drivers of growth as we head through the year, especially as higher interest rates take their toll.

In manufacturing, weak demand for goods is widespread with the exception of the US, where there is evidence that the inventory adjustment is more advanced than elsewhere, meaning destocking is acting as less of a drag. Once inventories are normalized elsewhere, demand will recover somewhat, but it remains to be seen how adversely affected demand will be from other factors, such as the increased cost of living and higher interest rates.

We therefore retain the impression from the data that, while recession appears to have been averted for now, there remains a strong possibility of substantially weaker economic growth later in the year as the lagged impact of higher interest rates feeds through to the economy, at the same time that the cost-of-living crisis has eroded real incomes.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source link