[ad_1]

Michael Blann/DigitalVision via Getty Images

Boyd Gaming Corporation (NYSE:BYD) caught my attention as a potential stock to consider, not due to its significant growth but because of its healthy cash flow and profitability. Amid a turbulent market affected by rising interest rates and a potential recession looming, this type of stock may bring a margin of safety to investors due to its strong fundamentals. Furthermore, the gaming industry has reported record-breaking demand numbers over the last year, majorly benefiting from the growth in sports betting, which was banned in the USA until 2018.

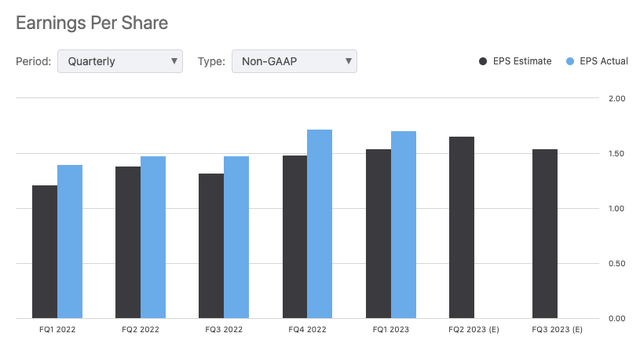

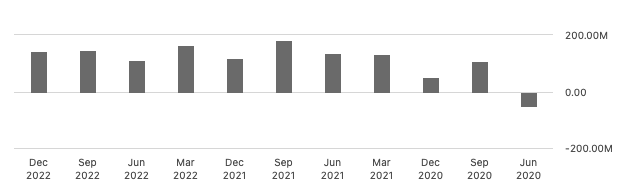

Earnings Per Share per Quarter (SeekingAlpha.com)

Boyd Gaming started its 2023 financial year on a solid note, beating EPS expectations for the fifth consecutive quarter in Q1 2023 by $0.17 to reach $1.71 and beating revenue expectations by $74.38 million to reach $963.97 million. Although cautious of the downward sales in its core land-based casino demand, Boyd Gaming’s diverse portfolio has shown its ability to deliver strong top and bottom-line results. With little growth in new land-based competition, steady demand and strong growth in its online business, investors may want to take a bullish stance on this stock.

Company overview

Boyd Gaming has grown through significant acquisitions and partnerships to establish itself as a major player in the gaming market, rooted in its land-based casino segments across Las Vegas, Midwest & the South. Boyd Gaming has a portfolio of 28 gaming properties across ten states in the USA.

Locations by State (Boydstyle.com)

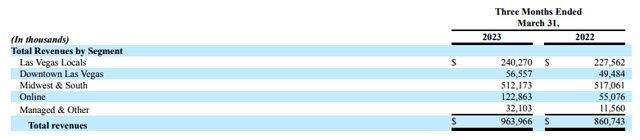

Over the years, the company has diversified its portfolio into online and mobile gaming operations throughout the U.S. and non-gaming industries. The company owns a travel agency and an insurance company with 5% ownership in FanDuel Group (DUEL) for sports betting. Its most recent acquisition was Pala Interactive in 2022 for $170 million. In its most recent Q1 2023 Earnings Report, the company has separately reported on its online revenue, indicating the growing impact on total sales. Thanks to its online strength, the company could compensate for decreased sales in its Midwest & South segment.

Q1 2023 versus Q1 2022 (sec.gov)

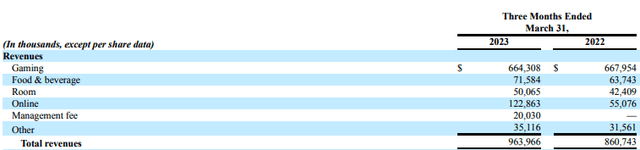

If we look at the breakdown of revenue according to what customers are spending, we can see that there has been a YoY decrease in gaming revenue for Q1 2023. However, its online segment has more than doubled YoY, and we have seen growth in all other forms of revenue.

Q1 2023 versus Q1 2022 (sec.gov)

Growth catalysts

Boyd Gaming’s diversified portfolio allows it to benefit from various growth factors. Firstly, its growing focus on online revenue streams has been key to its growth in Q1 2023. We saw online revenue more than double YoY. Online revenue includes its sports-betting partnership with FanDuel, third-party online market agreements, Boyd Interactive, and online casino business. Growth was largely due to the newly launched sports betting partnership.

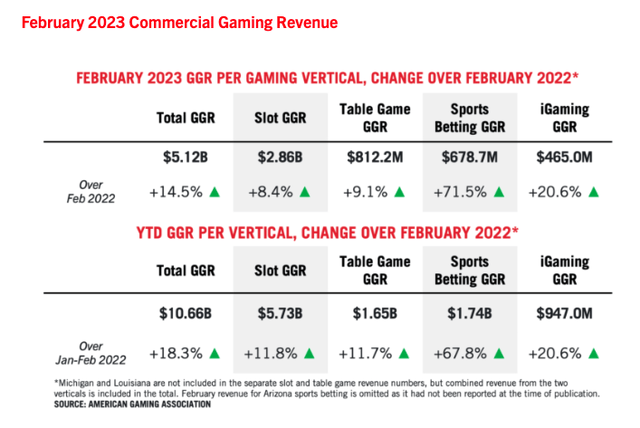

Secondly, we can see that while many industries have been negatively impacted by economic uncertainty over the last year, in 2022, casinos in Las Vegas broke earnings records. This demand has continued into 2023 if we look at statistics for commercial gaming revenue in February 2023. We can see that there has been impressive YoY growth across all gaming verticals, with a particular focus on sports betting, which increased by 71.5% YoY.

Commercial gaming revenue (Americangaming.org)

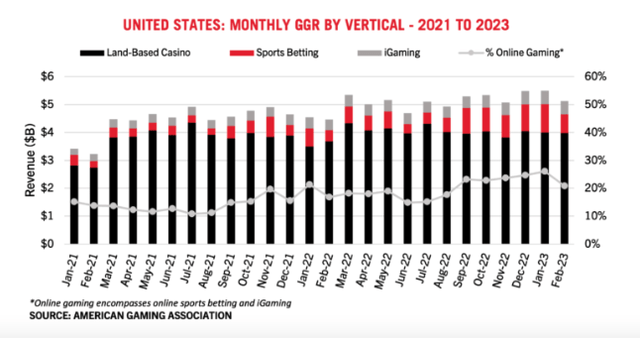

Looking at the trending monthly data by vertical, we can see a YoY healthy demand growth.

Trending vertical data (Americangaming.org)

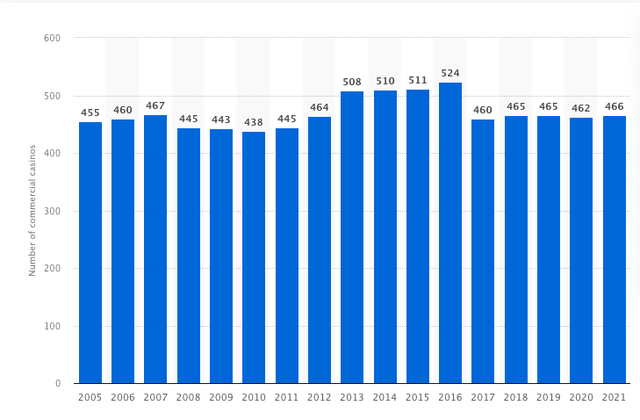

Lastly, Boyd Gaming’s land-based casino growth benefits from a lack of new competition in the market. Looking at the number of commercial casinos in the USA from 2005 until 2021, we can see a very flat growth trend. With minimal entrance into the market in the near future, we can assume that Boyd Gaming will maintain a healthy market share within this vertical of gaming.

Number of commercial casinos in the USA (Statista.com)

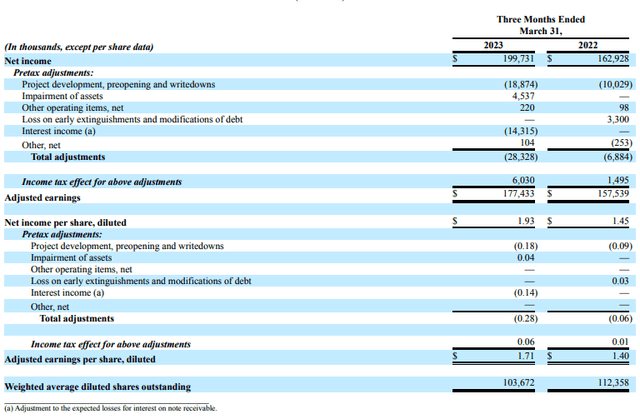

Q1 2023 Earnings

Boyd Gaming started its financial year off by beating EPS and revenue expectations for the fifth consecutive quarter. Revenue growth was due to its gaming and non-gaming diversified portfolio. Online operations positively influenced results more than doubling YoY growth. Q1 2023 revenue increased by 12% YoY to $964.0 million, net income increased to $199.7 million, $1.93 per share compared to $1.45 per share one year prior. EBITDA increased 8.4% YoY to $353.8 million.

Income statement Q1 2023 versus Q1 2022 (sec.gov)

Boyd Gaming’s robust positive free cash flow per quarter is an ongoing strength. This has allowed the company to reward shareholders with a dividend and share repurchase program while investing in diversifying its portfolio. Boyd Gaming has a dividend and share repurchase program. In Q1 2023, it repurchased $106 million in stock, and there is still $133 million available for repurchase. Furthermore, earlier this month, the company paid a dividend of $0.16 per share, an increase of $0.01.

Quarterly levered free cash flow (SeekingAlpha.com)

Boyd Gaming’s balance sheet indicates total cash of $263.5 million and total debt of $3.0 billion. While this may appear on the high side, it has no near-term debt maturities, low leverage of 2.3x and a credit facility with borrowing possibilities.

Valuation

According to MarketScreener, Boyd Gaming’s stock price has increased to an average target of $74.86 after a successful Q1 2023 earnings report. Analysts are optimistic about the stock’s performance in both the short and long term. Despite trading near historical highs, the stock has not surpassed the $70 mark yet.

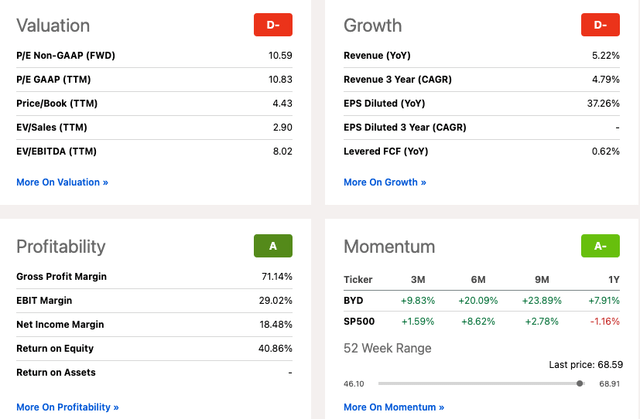

Historic stock trend (SeekingAlpha.com)

Over the past year, the stock price has grown by 14.1%. The valuation of the stock, according to SeekingAlpha’s Quant rating, has received a D- due to its high price-to-book ratio of 4.43. However, the FWD price-to-earnings ratio of 10.59 is favorable when compared to the consumer discretionary median of 11.81. Additionally, the stock has outperformed the S&P Index in both the short and long term, with a gross profit margin of 71.14% and a return on equity of 40.86%, making it an attractive investment opportunity.

Quant Valuation (SeekingAlpha.com)

Risks

Commercial gaming has been successful among consumers in recent times. However, if there is a recession, it could affect the performance of this consumer discretionary stock. Additionally, the company’s traditional land-based casino offerings have been declining, and there is concern that its online gaming growth could end up competing with its own business. Nevertheless, the company states that these offerings are complementary. Despite having no debt maturing in the near future, Boyd Gaming has accumulated a significant amount of debt due to its past acquisitions, which could be problematic if the business’s performance declines further.

Final thoughts

Although Boyd Gaming’s growth rate may not be the most impressive, it has consistently generated healthy profits and positive free cash flow from its diverse business portfolio. This has allowed them to reward shareholders and provide investors with a sense of security during these uncertain times. Additionally, the casino industry has shown significant demand, breaking records and indicating a continued appetite for gaming and entertainment despite market uncertainty over the past year. As such, investors may want to consider taking a bullish stance on BYD stock.

[ad_2]

Source link